In terms of how to get into venture capital, anyone typically has got the similar very first question:

“How do you break in? !! Tell me! “

The best way to Win Purchasers And Affect Markets with Startup VC

Tolearners and engineers, jaded financial investment bankers, and Uber/Lyft individuals, opportunity money actually sounds like the desire work: consider events with exciting business owners throughout the day then gamble cash on the perfect versions.

Wait in regards to few years, and then… increase! You’re wealthy.

Or, if things do not go as planned, inform your firm’s brokers “it is going to take more time” to have results.

And, going back to that very first query, how would you enter this “dream job”?

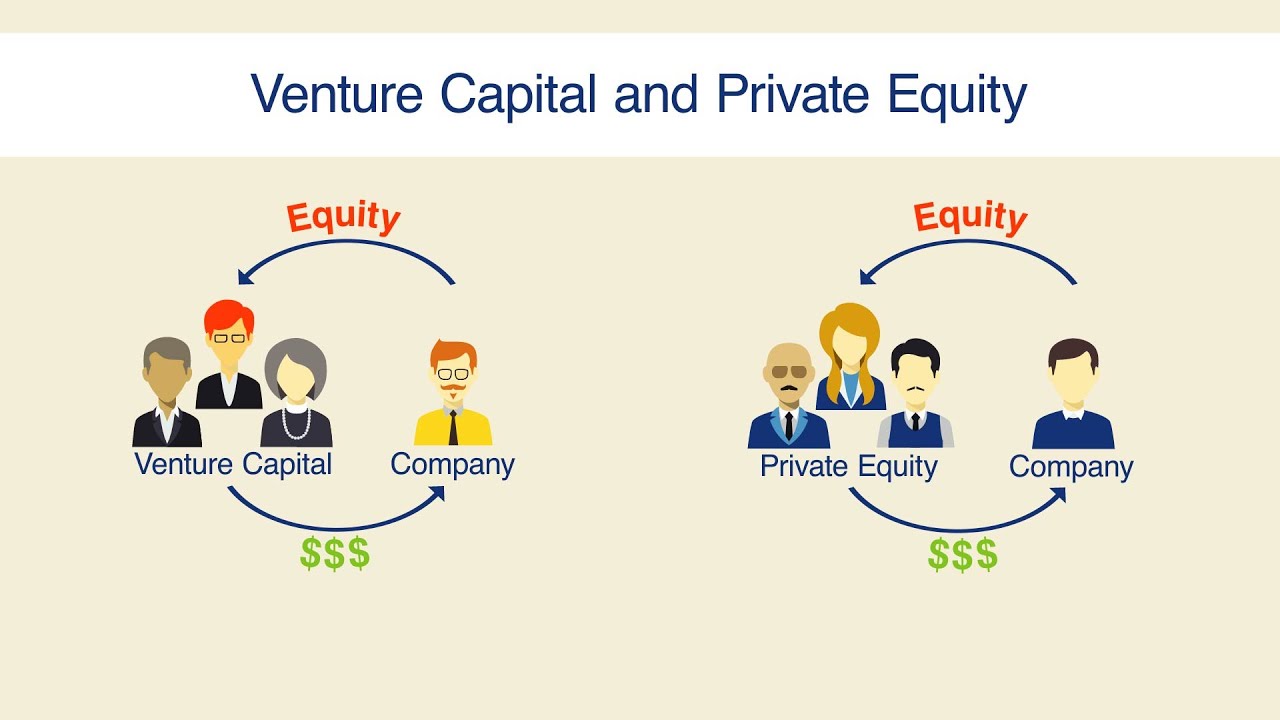

Venture cash firms improve capital from Limited Partners, such as pension cash, endowments, and family office buildings, and next invest in very early-level, high-improvement-prospective organizations in return for equity (i.e., acquisition in individuals companies).

Ever since the potential risks are really substantial, VCs anticipate the vast majority of their ventures to are unsuccessful.

When they look for the followingYahoo and google and Myspace, or Uber, they are able to generate extraordinary over-all earnings even if 90Per cent with their portfolio corporations fail.But>

Here’s some information on U.S. business dividends in excess of 10 years made by Correlation Ventures:

Yes, you’re reading this graph accurately: a total 65Percent of VC promotions lose cash or simply burst even.

Technically, enterprise capital happens to be an “investing” or “buy-side” function.

But it is another sales industry in places you be competitive for money and get to the finest startups.

There’s a whole lot cash going after so very few really good startups that developing access is usually the main challenge – this is why comes back are exceptionally focused among the list of leading few VC organizations.

Annual salary can be a important discounted to non-public equity pay out or expenditure banker earnings, so if “becoming rich ASAP” is the best primary life target, go across endeavor funds off of your directory of feasible positions.

For those who become a member of right after 24 months two years 2 years of business banking or referring with.Junior-stage opportunity funds jobs hardly ever lead to Lover-keep track of positions, so you will probably not work the right path up right into a senior citizen role>

Deals are simpler compared with IB or PE, there’s a smaller amount monetary modeling and range crunching, and also you spend more time on “sourcing” (getting providers) and sector researching.

So, there is only one good reason to strive for junior-amount VC functions: Make a community, and leverage it to gain other start up-connected assignments in the future.

Fore more on this theme, please see our write-up on endeavor funds employment opportunities.

Ways to get Into Venture Capital: Who Wins Interviews and Offers?

The three most important entry points into venture capital are:

Pre-MBA: You managed to graduate from institution and proved helpful in expenditure financial, supervision consultation, or small businessdevelopment and profits, or solution management in a startup for a long time.

Post-MBA: You probably did a thing to increase a back ground inhealth related and technician, or pay for for a few years ahead of company institution (e.g., architectural or profits at an endeavor computer software company), and then you visited a high business college.

Senior Level / Operating Partner: You properly established and exited a start up, or else you were actually a superior-level professional (VP or C-amount) at the substantial business that functions inside an market of interest to VCs.

We pinpoint the pre-MBA route here considering that you are most probably within that class, but almost all of the recommendations the following are highly relevant to the publish-MBA pathway at the same time.

It’s hard to get into endeavor cash directly away from undergrad, and perhaps if you possess the back ground for doing this – i.e., you went to Stanford or Berkeley, majored in CS, and accomplished many startup and fund internships – it’s not necessarily the best idea to get it done.

To always be beneficial to a VC business, you require some full time, actual-entire world knowledge as well as minimum the beginnings of the specialized network.

How does a venture capitalist make money?

Venture capitalists make money in 2 ways: carried interest on their fund’s return and a fee for managing a fund’s capital. … Investors invest in your company believing (hoping) that the liquidity event will be large enough to return a significant portion: all of or in excess of their original investment fund.

Venture capital internships for the duration of undergrad are certainly more plausible and are generally normally a beneficial approach to acquire expenditure banking functions later on.

This also is generally hard to shift right from a real technology role into VC firm malaysia mainly because customer and current market investigation subject much more than programming expertise or specialised abilities.

Yes, we’ve featured subscribers who definitely have done it, but it is quite uncommon.

Management experts may have a little a plus more than bankers, but it surely relies on their track record: advising on HR guidelines for insurance firms is far a lot less pertinent than advising on technique for computer companies.

The place Can You find Free Venture Capital Sources

reputation, Over-all and pedigree still matter a lot for VC tasks, and companies are likely to love applicants with manufacturer-brand companies and educational institutions with their resumes.

Tips to get Into Life Science Venture Capital: The Exception That Proves the Rule

The last observe: existence research business funds (biotech, pharmaceuticals, health devices, and so on.) is different from computer project capital, as well as ahead of time-phase existence scientific disciplines VC capital, scholastic expertise numbers for a lot.

They often recruit Ph.D.’s from very best schools who definitely are professionals in an division of attraction for those organization, plus they do not necessarily call for business banking or contacting encounter or even an MBA to get in.

However, you continue to require some business/financing knowledge, generally acquired by starting off your company, having programs, or accomplishing pertinent internships.

The truth About Venture Capital In 3 Minutes

Also, they really want state-of-the-art clinical know-how: an undergraduate or Master’s education in biology is not satisfactory if you do not have other, remarkably applicable expertise, including founding a biotech new venture or operating in medical expenditure consumer banking or fairness investigation.

Late-stage existence scientific research VC resources have a tendency to attention a little more about pay for experience, so if you are more of a fund human being with some information about scientific research, later-point resources may well be a more effective suit.

What Qualities Do Venture Capitalists Seek in Recruits?

Junior-amount VC assignments (“Associates”) vary in accordance with the firm’s shelling out point, field concentration, and tactic:

Something diffrent?

Investing Stage: Early point? Late level? Even closer to development equity?

Industry Focus: Technology? Life sciences? Cleantech? A selected area inside one of those? Something diffrent?

Strategy: Does the company take more time on investment portfolio business procedures, obtaining new investments, doing business analysis, or something that is more? Will it obtain new investment strategies by means of outboundtestimonials and marketing and advertising, or perhaps a far more records-powered method?

Old fashioned Startup VC

VCs want to sponsor presentable, VC firm malaysia remarkably articulate specialists with a passion for startups in excess of number crunchers with limited need for startups.

The World’s Worst Advice On Startup Venture Capital

This is particularly the way it is at beginning-step providers, which pay attention to sourcing, establishing networks, and starting conferences to succeed discounts and raise money.

Even there, the evaluation is fairly basic in contrast to the regular IB/PE bargain.At past due-step providers, option delivery and homework be more important>

Venture capitalists want professionals who carry sturdy thoughts about different firms and sectors and that can rationalize their views depending on current market and customer research, not the product or service/technical facts (maybe not as accurate in life sciences).

If you are a greater portion of a fund guy or number cruncher, then you definately need to concentrate on past due-point providers or development fairness agencies.

Getting Into Venture Capital: The Total Recruiting Process

There are not too many junior-degree VC careers, as well as accessible work tend to be concentrated in certain regions, like the coasts with the U.S.

It’s not easy to gain these tasks because:

1. The same as other get-side roles, VCs will not “need” an army of junior staff members to churn never-ending docs to seal offers.

2. VC agencies are level partnerships with preset budgets determined by possessions less than control, so each new use straight lessens the income of the Partners. Closing promotions is not going to bring about a lot more revenue or maybe a higher finances inside the in the vicinity of phrase.

3. ” without the need of essentially understanding the occupation at length.

As a result of these aspects, the venture capital sponsoring method is unstructured and exactly like the out-period confidential value sponsoring course of action.

Several of the larger organizations, like Sequoia, New Enterprise Associates, and Accel, could use headhunters, and the selection of brands is acquainted: during the U.SCPI, Oxbridge and . and Glocap generally have a steady stream of positions.

In Europe, KEA Consultants and PE Recruitment (PER) offer you quite a few VC functions.

These headhunters will never essentially contact you proactively years ahead of the career start out night out.Contrary to in exclusive collateral recruitment>

You’ll have to be a lot more assertive with acquiring testimonials, getting in touch with them, and wanting to know specially about business budget – or, can be done the network your own self and go about headhunters.

You should begin by thinning down the types of resources you wish to just work at, hunting for specialists on LinkedIn, and after that emailing them to seek recommendations on getting into VC.

Cracking The Startup VC Secret

You are able to follow the example e-mail web templates here or perhaps in articles or blog posts for example the a single on mid-market personal collateral enrolling.

Remember, asking for assistance with engaging in the current market is commonly more efficient than questioning right for a occupation.

In the event the strong has no urgent hiring demands, or it can be through rapidly – in a thirty days or much less – if they need to remove and replace an individual right away.The recruiting approach can drag on for months>

You’ll start with phone interviews, however, you must plan to match absolutely everyone in the business, or everyone in the group of people at the big providers, multiple times right before earning an offer.

Interviews are everyday and conversational, and VC interviewers put a laser beam concentrate on “fit.”

Case scientific tests and small modeling testing are attainable, but they are much less probably compared with private equity interview (just where they are guaranteed to appear).

Venture Capital Interview Questions and Answers

Venture investment capital interviewers ask questions that are similar to kinds you would obtain in commercial growth, financial investment consumer banking, or confidential collateral interviews…

…but the circulation and focus from the queries are considerably diverse.

Unlike in financial investment business banking interview, you will not be quizzed for half an hour on WACC or Equity Value or. Enterprise Value or perhaps the tax bill treatment of outlined-gain pension obligations.

Fears of a professional Venture Capital Funding

Technical problems could nonetheless appear, but VCs care and attention a lot more regarding market place views and expenditure tips as well as your match their staff.

So, in difficult obtain of relevance, allow me to share the dilemma classes you can anticipate:

“Fit” and Background Questions – Your continue, why venture money, why this organization, your strengths and weaknesses, etc.

Investment decision and Current market Questions – Which start up could you spend money on? Which market is attractive? Which marketplaces must we steer clear of?

Firm-Specific and Process Questions – What do you think about our investment portfolio? Which providers would you have committed to or perhaps not dedicated to? Would you assess a possible financial investment making a decision?

Deal, Client, and Fundraising Experience Questions – How have you include price within the IB offers you’ve worked on? How would you get even more clients or spouses inside of a income or BD position should you proved helpful for a startup?

Technical Questions – You could get regular concerns about accounting and valuation, as well as VC-distinct questions regarding limit desks, critical metrics in your field, and how to benefit startups and sizing sells.

You could get a shorter expense suggestion or perhaps a industry/company research, even if official Instance Modeling and Scientific tests Checks – These include more unlikely that.

Here are case in point questions and answers in each one classification:

Venture Capital Behavioral Interview Questions and Answers

Walk me via your continue.

See our guide and examples for that “Walk me using your resume” concern, and also the short article in order to step through your job application in purchase-part job interviews.

Because you are enthusiastic about having a wide variety of startups, helping them grow, VC firm malaysia and discovering appealing new corporations – and you would like that to starting off your personal organization or perhaps a real bargain-setup purpose.

Where would you see by yourself in five or 10 years?

The answer relies on whether or not you’re interviewing to obtain a Partner-path location, which usually means “post-MBA part.”

3 Undeniable Details About Venture Capital Funding

For anyone who is, than the only appropriate answer is “I would like to go on in endeavor cash, progress, making a long term job than it.”

How To turn Startup VC Into Success

Or else, then you could say that you would like to utilize begin-ups eventually, however, you realize that job hopefuls ordinarily move into something else after a few several years.

So, you could possibly point out a similar employment, just likemethod and financing, or business advancement at a technology start up, then say that during the longer term, you want to resume VC with a advanced level.

What are your flaws and talents?

See our step-by means of, guidebook, and examples. For VC, your talents will incorporate points like “communication/business presentation skills” and “networking skill.”

For weak spots, it would be okay to state that you never get the greatest quantity-crunching techniques or that you just do not know bookkeeping in nearly as much height as other contenders.

Why not private equity, hedge money, or entrepreneurship?

Because you are excited about computer or living scientific discipline startups, and you would not get the similar options to utilize them in non-public collateral or hedge cash.

You’re not keen on starting your individual corporation simply because you like putting and telling value to profile firms and getting a bird’s-vision take a look at the industry in lieu of focusing on a single notion for a long time.

Venture Capital Market and Investment Interview Questions and Answers

These problems are crucial if you wish to discover how to go into project cash – if you never have powerful expenditure and market tips, you may have no online business getting on the market.

Which start-up can you invest in? Why?

Just like hedge account stock pitches, you need to researching trading markets and corporations and produce 2-3 stable strategies in this article.

In VC, the opportunity upside things a lot more than the risks as most investments stop working anyway.

So, a single popular approach is usually to say that other individuals ignore the real height and width of the company’s industry or how fast it can expand – however you think it could actually extend swiftly into Markets A, B, and C, so that it is worthy of far more than the opinion perspective.

You may have used this common sense to pitch a firm like Uber again as it started out, and quite a few people today didn’t realize it is true possible.

Also why the corporation is ideal installed to take advantage of it.If you’re requested about a specific corporation, you will need to describe not only for why its industry is misunderstood>

Which financial markets are most attractive to you? Why?

See previously – the only real variation is this particular one is definitely more about full trading markets wondering and VC firm malaysia fewer about specific providers.

Which marketplaces ought to we stay away from?

You’ll make reverse issue listed here and declare that a market is even worse compared to comprehensive agreement viewpoint for the reason that it is smaller compared to required, it is going to develop slower than required, or it will require for a longer time to produce.

As an example, you may believe that man made intellect in healthcare is not really a fantastic close to-time period marketplace because the engineering is much further more aside than envisioned, and authorized/regulatory boundaries and societal norms can prevent extensive adoption anytime soon.

If the business is interested in AI purchases, it needs to concentrate on regions that don’t have these same challenges.So>

What are the distinct business kinds of application/online startups? The one that is easily the most pleasing?

Common designs involve 1-time expenses, marketplaces (eBay or Etsy), subscribers (Salesforce or Netflix), freemium (Evernote and plenty of cell apps), profits (Airbnb and crowdfunding sites), advertising (Facebook and Twitter), royalties/certification, and blockchain/token economic climate (Bankex).

The most appealing one will depend on the VC firm’s plan as well as the company’s sector.

Folks normally consider that membership-based application is the best model simply because it features continual sales.

For example>However, that ignores cancellations, preliminary income-supply challenges being the business ramps up, and the fact that not every marketplaces offer on their own to long term subscribers.

When the item is a company method used by significant companies consistently, subscribers could be the greatest model, however they might not function as effectively to get a client product with brief-phrase use instances (e.g., going out with software).

Firm-Specific and Process Interview Answers and questions

These questions will also be essential in venture money recruiting because agencies value “fit” a whole lot – if you have not explored the organization and it is collection extensively, they will determine rapidly.

What do you think of our own account? Which corporations might you have devoted to or otherwise not bought?

It is advisable to investigate the firm’s portfolio, look up their expense thesis, and learn how strongly the firms match up it to resolve that one.

Seven Ways to Make Your Venture Capital Simpler

It’s ideal to target 1-2 corporations and get ready in-depth thoughts on them rather then attempting to handle all the things.

Once you’ve chosen them, this is just one other type with the “Which start up might you invest in? ” 1.

Who happen to be our primary competition? How must we separate versus them?

This one involves essential research… useGoogle and Pitchbook, or Capital IQ, and find comparable, current promotions where other VC providers expended. Those is definitely the probably competition.

Would you evaluate one of our profile firms? Which facts do you obtain to take action?

You’d request information regarding the things that typically enter into a VC pitch deck: system, current market and group competitive gain, enterprise model, and get out of options.

Venture Capital Funding For VC firm malaysia Freshmen and everybody Else

You’d need to see a highly trained, qualified staff in a very sizeable and rapid-expanding marketplace using a obvious very competitive advantage in addition to a enterprise model that allows them to earn cash without dependant upon outside the house funding – and the organization should have the possibility to become excellent acquisition targeted or IPO choice.

Picture Your Startup VC On Prime. Learn This And Make It So

You will obtain facts oncustomers and buyers, indicator-up premiums, cancellation rates, and financial efficiency, along with existence sciences, medical trial offer records.

Deal, Client, and Fundraising Interview Questions

It is generally a smaller amount critical due to the fact VC discounts are rather easy.Your option knowledge could come about in project funds interviews>

For those who have an IB qualifications, you ought to summarize your specials through using the illustrations from the financial investment business banking package page, and you should opt for bargains who have some applicability to endeavor funds – a technical or medical IPO, a joints business among two software programs corporations, or something that expected considerable market investigation.

Startup Venture Capital – Not For everybody

You should also go on a crucial take a look at every cope and talk about why you would or will not have tried it should you have had been the consumer or institutional investors.

Venture Capital Technical Interview Answers and questions

You might still get standard data processing/valuation inquiries in venture money enrolling, but they will usually have more of a “VC spin.”

Consider our Uber valuation to view the method that you could possibly appeal a high-development/start up provider.

What’s the primary difference amongst pre-income and blog post-dollars valuations?

The “pre-hard earned cash valuation” is really a startup’s Equity Value right before it concerns new reveals to your VC company, plus the “post-cash valuation” is definitely the startup’s Equity Value after that will happen.

And this also boost in funds was attributable to the shareholders.Fairness Price grows when new offers are given for the reason that Whole Property increases due to the cash>

Enterprise Value fails to modify during these moments as this is basically a funding pastime.

So, should the company’s pre-income valuation is $ten million before it improves $5 zillion in home equity with a VC company, its submit-hard earned cash valuation is $15 mil, along with the VC agency is the owner of 1/3 of this.

Just what are the industry-offs associated with a standard equity credit as opposed to. convertible notices?

Using convertible remarks makes it easier to close specials since it lets the investors and business defer the company’s valuation and as a result, dilution) until a after time frame.

However, additionally they cause it to confusing to ascertain everyone’s acquisition percentages simply because the company wants a valued home equity spherical to achieve that – which will usually result in surprises.

Equity financing is a lot more easy for the reason that company’s valuation needs to be defined, but it could be much harder to close since all parties have to recognize this valuation.

For much more, see Fred Wilson’s thoughts on the issue (he’s not keen on convertibles).

What are some of the vital proportions and metrics for SaaS businesses?

a16z possesses a fantastic review of SaaS metrics here.

The two most vital models are most likely LTV (Lifetime Value) and CAC (Customer Acquisition Cost) and also the ensuing LTV / CAC rate.

CAC should are the whole prices of buying an “average” shopper (nonetheless it usually does not), as well as the LTV must indicate that clients inevitably end and that each shopper has a average life-span.

Sometimes, it is best to be conservative and use a 12-four weeks or 24-30 days LTV instead of producing way-in-the-potential presumptions regarding the lifetime.

How does one benefit a corporation with bad hard cash flows for your foreseeable future?

Either use replacement strategies, like multiples according to Daily Active Users or Monthly Active Users, or project the business until finally its cash passes flip favorable in the far-away long term (prevalent for biotech businesses the place that the affected person costs and add up are identified portions).

Guess that our organization invests $10 million for the 20% risk in a very start up. This start up later on functions into huge very competitive problems and carries on its own for only $30 mil.

Rather earn backside our initial $10 million financial investment, even if

Nevertheless, we all do not lose cash in the option. How is feasible?

{{Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding}! {3|4|5|6|7|{3|4|5|6|7|8|9|10|Three|Four|Five|Six|Seven|Eight|Nine|Ten} {Tricks|Methods|Tips} The {Competition|Competitors} {Knows|Is aware of}, {But|However} {You don’t|You do not}|{3|4|5|6|7|8|9|10|Three|Four|Five|Six|Seven|Eight|Nine|Ten} Ways You Can Reinvent {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding} Without Looking Like An Amateur|Life After {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding}|Free {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding} {Coaching|Teaching} Servies}

{Most likely|Probably|More than likely|Almost certainly|Most probably|Likely}, the {firm|company|organization|business|strong|agency} {invested|spent|put in|devoted|expended|sunk} {with a|having a|using a|by using a|which has a|that has a} liquidation {preference|choice|desire|personal preference|inclination|liking}, {which means that|meaning|meaning that|which means|so that} they {receive|get|obtain|acquire|be given|collect} {back|back again|rear|again|lower back|backside} some {multiple|several|numerous|a number of|many|various} {of their|of the|with their|in their|of these|of their own} {investment|purchase|expense|expenditure|investment decision|financial investment} ({often|frequently|usually|typically|generally|normally} 1x) {before|prior to|just before|well before|ahead of|right before} other {groups|organizations|teams|groupings|communities|categories}, who {often|frequently|usually|typically|generally|normally} {hold|keep|maintain|carry|have|store} {common|typical|frequent|popular|prevalent|widespread} {shares|gives|offers|reveals|conveys|gives you} {instead of|rather than|as opposed to|as an alternative to|rather then|in lieu of} {preferred|favored|desired|recommended|chosen|ideal} {shares|gives|offers|reveals|conveys|gives you}, {get paid|receive money|get compensated|get money}.

{

This {term|phrase|expression|word|time period|name} {reduces|decreases|minimizes|lowers|lessens|cuts down} {the risk of|the potential risk of|the chance of|the danger of|the possibility of|potential risk of} VCs {losing|dropping|shedding|burning off|getting rid of|giving up} {money|cash|funds|dollars|income|hard earned cash} {in cases where|in instances where|in situations where} {the company|the business|the organization|the corporation|this company|the firm} {is not|will not be|is not really|is just not|is simply not|is absolutely not} {a complete|an entire|a total|a whole|a thorough|an extensive} {failure|malfunction|failing|breakdown|disappointment|disaster}, but disappoints {in some way|in some manner|somehow|for some reason} {and has|and it has|and contains|and possesses|and also has|and has now} {to sell|to market|to promote|to offer|to trade|to dispose of} {for a|for any|to get a|for the|for your|to obtain a} {lower|reduced|reduce|decrease|cheaper|lessen}-than-{expected|anticipated|predicted|envisioned|estimated|required} {price|cost|value|selling price|price tag|rate}.

|Disappoints {in some way|in some manner|somehow|for some reason} {and has|and it has|and contains|and possesses|and also has|and has now} {to sell|to market|to promote|to offer|to trade|to dispose of} {for a|for any|to get a|for the|for your|to obtain a} {lower|reduced|reduce|decrease|cheaper|lessen}-than-{expected|anticipated|predicted|envisioned|estimated|required} {price|cost|value|selling price|price tag|rate}.This {term|phrase|expression|word|time period|name} {reduces|decreases|minimizes|lowers|lessens|cuts down} {the risk of|the potential risk of|the chance of|the danger of|the possibility of|potential risk of} VCs {losing|dropping|shedding|burning off|getting rid of|giving up} {money|cash|funds|dollars|income|hard earned cash} {in cases where|in instances where|in situations where} {the company|the business|the organization|the corporation|this company|the firm} {is not|will not be|is not really|is just not|is simply not|is absolutely not} {a complete|an entire|a total|a whole|a thorough|an extensive} failure>}

{What is a|Exactly what is a|What exactly is a|Just what is a|Precisely what is a|Just what} {cap|cover|limit} {table|desk|kitchen table|dinner table|dining room table|family table}? {How do you|How can you|How will you|How would you|How does one|Just how do you} {use it|utilize it|apply it|make use of it|put it to use|work with it}?

A “cap {table|desk|kitchen table|dinner table|dining room table|family table},” or capitalization {table|desk|kitchen table|dinner table|dining room table|family table}, {shows|demonstrates|reveals|displays|exhibits|illustrates} {all the|all of the|each of the|every one of the|most of the|the many} {equity|value|home equity|collateral|fairness} {investors|traders|buyers|brokers|shareholders|purchasers} {in a|inside a|within a|in the|in a very|inside of a} {startup|start-up|start up|new venture} {and the|as well as the|and also the|along with the|plus the|as well as} {{type|kind|sort|variety|style|form} and {number|amount|quantity|variety|range|multitude}|{number|amount|quantity|variety|range|multitude} {and type|and kind}} of{{shares|gives|offers|reveals|conveys|gives you} and {options|choices|alternatives|possibilities|selections|solutions}|{options|choices|alternatives|possibilities|selections|solutions} and {shares|gives|offers|reveals|conveys|gives you}}, and {warrants|justifies} they {own|very own|personal|individual|own personal|possess}, {along with|together with|in addition to|as well as|in conjunction with|alongside} any {special|unique|specific|particular|exclusive|distinctive} {terms|conditions|terminology|phrases|terms and conditions|words} (e.g., liquidation {preferences|choices|personal preferences|tastes|inclinations|requirements}).

{It includes|It provides|It contains|It offers} the{{founders|creators} and {employees|workers|staff|staff members|personnel|people}|{employees|workers|staff|staff members|personnel|people} and {founders|creators}}, and {outside|outdoors|exterior|outside the house|external|out of doors} {investors|traders|buyers|brokers|shareholders|purchasers}, {and sometimes|and often|and quite often|and in some cases|and frequently|and in most cases} {it includes|it provides|it contains|it offers} {lenders|loan providers|loan companies|creditors|financial institutions|loan merchants} {and other|as well as other|along with other|and also other|together with other|and various other} {groups|organizations|teams|groupings|communities|categories} {as well|too|also|at the same time|likewise|on top of that}.

{{3|4|5|6|7|8|9|10|Three|Four|Five|Six|Seven|Eight|Nine|Ten} Tips For Using {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding} To Leave Your Competition In The Dust|The Stuff About {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding} You {Probably|In all probability|Most likely} Hadn’t {Considered|Thought of|Thought-about}. And {Really|Actually} {Should|Ought to}|The Foolproof {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding} Strategy|The Ultimate Secret Of {Venture Capital|Startup VC|Startup Venture Capital|Venture Capital Funding}}

Companies {use the|make use of the|utilize the|take advantage of the|work with the|makes use of the} {cap|cover|limit} {table|desk|kitchen table|dinner table|dining room table|family table} to {calculate|determine|compute|estimate|evaluate|assess} dilution from {funding|financing|backing|money|funds} rounds, {employee|worker|staff|personnel|member of staff|staff member} {stock|carry|supply|inventory|store|share} {options|choices|alternatives|possibilities|selections|solutions}, and issuances {of new|of brand new|of the latest|newest} securities, {and to|and also to|as well as|as well as to|also to|and} {calculate|determine|compute|estimate|evaluate|assess} the {proceeds|earnings|profits|cash} to {everyone|everybody|every person|anyone|absolutely everyone|all people} {in an|within an|inside an|in a|in the|within the} {exit|get out of}.

Venture Capital Case {Studies and Modeling|Modeling and {Studies|Research|Scientific studies|Reports|Research projects|Scientific tests}} Tests: {What to Expect|What to anticipate|What you should expect|What to prepare for|What to look for}

As I’ve {repeatedly|consistently|frequently|continuously|regularly|over and over again} {mentioned|pointed out|described|talked about|stated|outlined}, {formal|official|professional|conventional|proper|elegant} {case|situation|circumstance|scenario|instance|event} {studies|research|scientific studies|reports|research projects|scientific tests} and modeling {tests|assessments|exams|checks|testing|examinations} {are not|usually are not|are certainly not|will not be|are usually not|may not be} that {common|typical|frequent|popular|prevalent|widespread} in VC {interviews|job interviews|interview} {you’re|you are} {more likely to|more prone to|very likely to|prone to|quite likely going to|almost certainly going to} {get into|enter into|go into|end up in|enter|wind up in} {a deep|an in-depth} {discussion|conversation|dialogue|talk|topic|debate} {of your|of the|of your own|of your respective|within your|from your} {investment|purchase|expense|expenditure|investment decision|financial investment} {ideas|suggestions|tips|concepts|thoughts|strategies}.

{

But {if you do|should you|should you do|if you|should you choose|in the event you} {get a|obtain a|get yourself a|have a|receive a|acquire a} {written|composed|created|published|prepared|authored} {case|situation|circumstance|scenario|instance|event} {study|research|review|examine|analysis|investigation}, {it might|it may|it could|it may possibly|it may well|it could possibly} go {something like|something similar to|something such as|such as|similar to} this:|{If you do|Should you|Should you do|If you|Should you choose|In the event you} {get a|obtain a|get yourself a|have a|receive a|acquire a} {written|composed|created|published|prepared|authored} {case|situation|circumstance|scenario|instance|event} {study|research|review|examine|analysis|investigation}, {it might|it may|it could|it may possibly|it may well|it could possibly} go {something like|something similar to|something such as|such as|similar to} this,

But:}

“Consider Startup X. Describe {the company|the business|the organization|the corporation|this company|the firm}, its {market|marketplace|industry|market place|sector|current market} {segment|section|sector|portion|market}, its {market|marketplace|industry|market place|sector|current market} {size|dimension|dimensions|sizing|measurement|measurements}, and {do a|perform a|conduct a|execute a|carry out a|complete a} {brief|short|quick|simple|limited} {competitive|aggressive|very competitive|competing|reasonably competitive|cut-throat} {analysis|evaluation|assessment|examination|investigation|research}. Estimate the company’s {future|long term|upcoming|potential|potential future|near future}{{revenues|earnings|profits|income|earning potential} and {profits|earnings|revenue|income|sales|gains}|{profits|earnings|revenue|income|sales|gains} and {revenues|earnings|profits|income|earning potential}}, and {growth|development|progress|expansion|advancement|improvement}, {and use|and make use of|and utilize|and employ|and apply|and workout} {those|these|individuals|all those|people|the} {to determine|to find out|to figure out|to ascertain|to discover|to know} its {potential|possible|prospective|probable|likely|possibilities} {value|worth|benefit|importance|price|appeal} {in an|within an|inside an|in a|in the|within the} IPO or M{&|And}A {exit|get out of}.